ENJOY 50% XERO PSG Grant with EBOS

SMEs are eligible for up to 50% Productivity Solutions Grant (PSG) support for the adoption of XERO Accounting Software

Book your 30mins Complimentary Consultations

Stand a chance to win 1-year FREE XERO accounting software by engaging with us now!

Why hundreds of SME’S believe in ebos

As EBOS is one of the few companies that is a certified advisor for four Cloud Accounting applications, SMECEN Dashbod (PSG), Enterpryze, Financio, and Xero (PSG). We are able to identify the best way for companies to utilize Cloud Accounting irrespective of their industry and advise you on the best ways to digitalise your business. From setup, implementation, and training all the way to support, EBOS guides you every step of the way on your digitalization journey! Testimonial from Google and Facebook is the best evidence of our commitment.

What’s more, is that EBOS offers exclusive benefits that you cannot get from subscriptions directly with other Cloud accounting solutions providers. These include:

- Bespoke training for a minimum of 4 cloud accounting solutions; Available in English & Mandarin

- Customized Charts of Accounts and setup for tax planning.

- Professional customization with all ranges of apps to suit your business need

- Speedy response as we are well versed with the software and we have direct access to the Key Accounts Managers.

Why Choose Xero Accounting Software?

Xero is a cloud-based accounting software that connects people with the right numbers anytime, anywhere, on any device. For accountants and bookkeepers, Xero helps build a trusted relationship with small business clients through online collaboration, helping over 2 million+ subscribers worldwide transform the way they do business

Xero allows for financial tasks to be completed automatically with auto bank reconciliation and bank integration, Xero helps to reduce accounting costs, reduction in staff manpower and staff manhours and enabling improved financial decision-making by company executives through real-time data and consolidated reports.

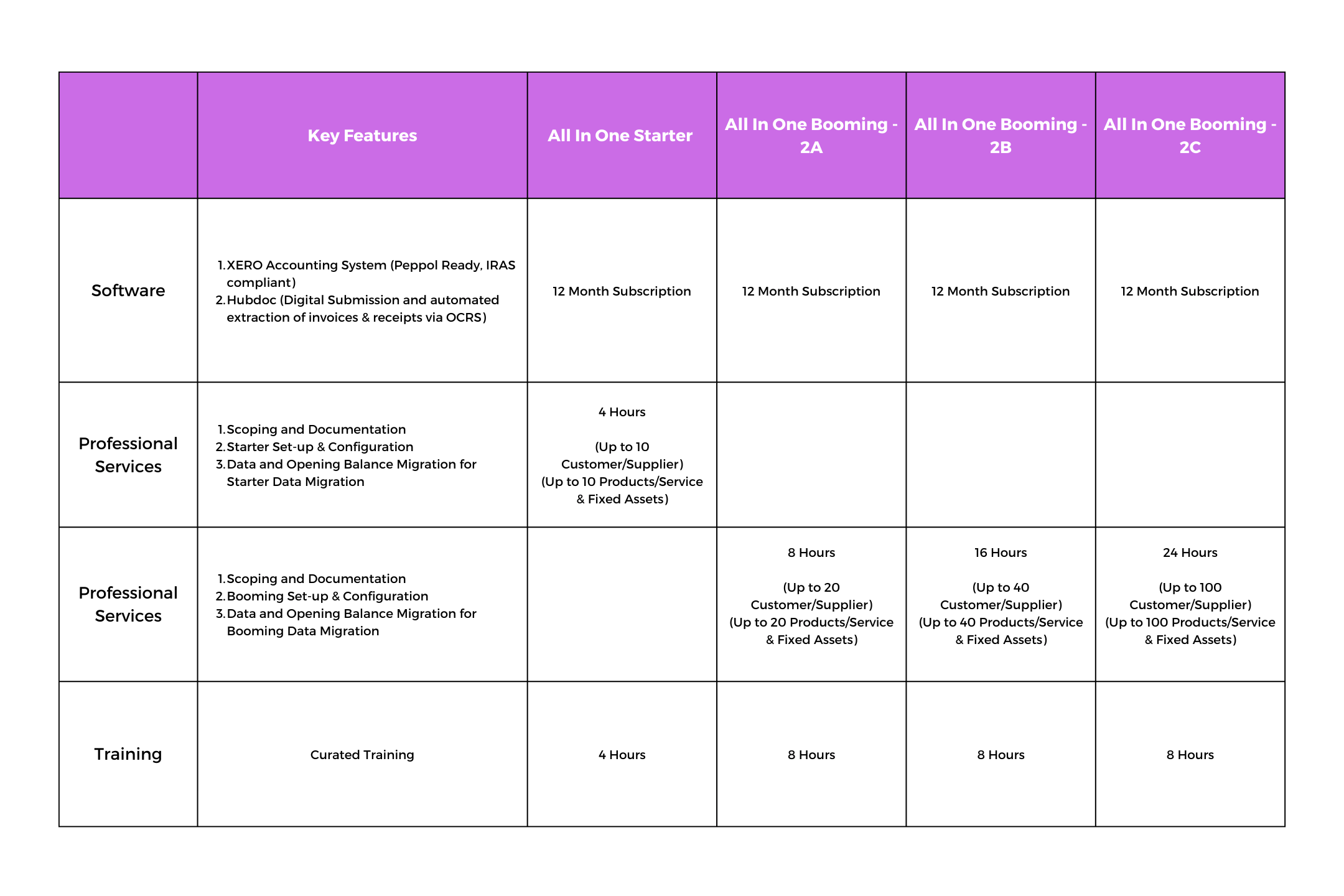

4 PSG PRE-APPROVED XERO PACKAGES

Book your 30mins Complimentary Consultations

Stand a chance to win 1-year FREE XERO accounting software by engaging with us now!

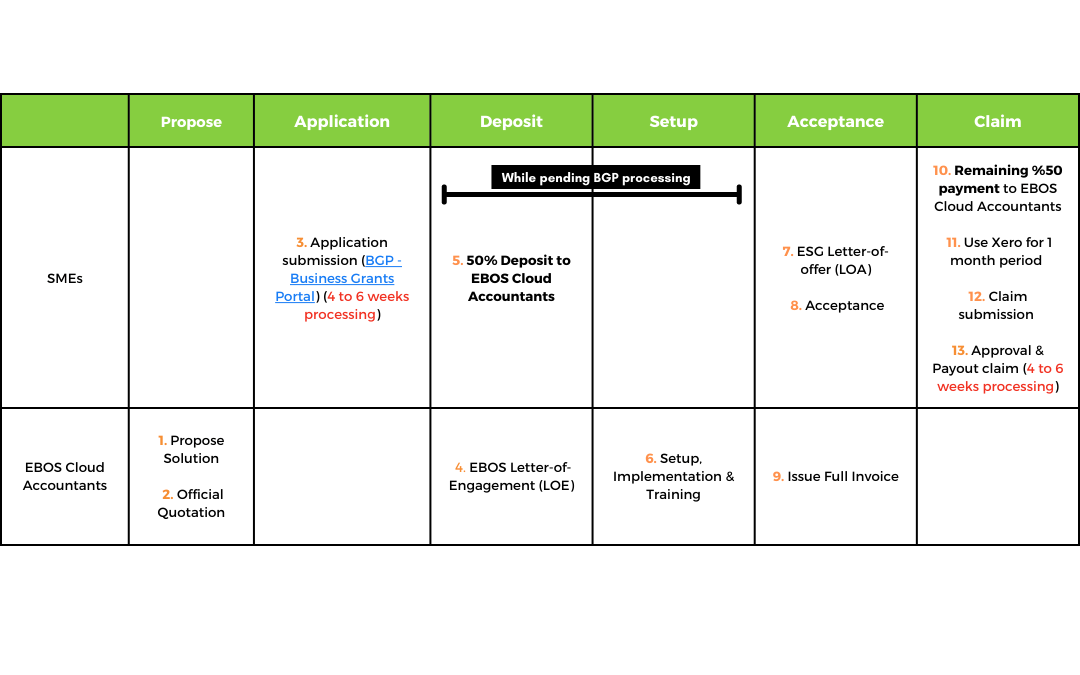

HOW TO APPLY?

Should you be eligible for PSG grant, follow the steps below :

- Get in touch with our success team to get a quotation within 3 days

- Submit a Subsidy application on the Business Grants Portal using your CorpPass

- Accept your letter of offer once approved. Approval takes around 4-6 weeks upon submission

APPLICATION PROCESS

FREQUENTLY ASKED QUESTIONS

Why should I choose EBOS to set up my Cloud Accounting?

- We have been consultants for SMEs for more than 10 years. We did not just support 1 cloud Accounting software, we are recognised as professional trainers with 4 IRAS compliant softwares in Singapore. As such, our 10 years of experience in SMES allows us to provide your company with greater knowledge and targeted recommendations no matter which industry you are in.

- We have a total of 9 Pre-approved Packages under PSG and 6 Pre-approved Package under DGG.

How EBOS Cloud Accountants can help you?

- EBOS helps to guide businesses on their cloud accounting journey with Xero. Companies can connect Xero to their bank for automatic bank feeds and easily sync bank and financial information directly to automate their administrative tasks.

With integrated mobile app for Xero, they can store documents online for quick access and capture bills and receipts via email, or scan files from their mobile. They can also access Xero to view a summary of money coming in and going out on the Xero dashboard, and in cash flow reports as well as tons of flexible features available to suit each company’s needs.

Xero is also InvoiceNow ready and lets businesses send and receive e-invoices directly between their accounting software systems via the Peppol network.

What is Productivity Solution Grant (PSG)?

The Productivity Solutions Grant (PSG) is a joint initiative of Infocomm Media Development Authority (IMDA) and Enterprise Singapore that covers areas from Accounting, Human Resources Management, Inventory Management, POS, and e-commerce system to encourage companies to adopt IT solutions to optimize business processes.

PSG offers up to 50% subsidization support, enabling organizations to make long-haul innovation ventures and likewise to launch their digitalization initiatives in order to bolster Singapore’s business digitalization efforts for all SMEs and MNCs.

Who is eligible for PSG Grant?

- Registered and operating in Singapore

- Purchase/lease/subscription of the IT solutions or equipment must be used in Singapore

- Have a minimum of 30% local shareholding; with Company’s Group annual sales turnover less than S$100 million, OR less than 200 employees (for selected solutions only)

Can I claim 18% Enterprise Singapore's SkillsFuture Enterprise Credit (SFEC)?

During the recent Budget 2022, Minister for Finance, Lawrence Wong, announced that the SkillsFuture Enterprise Credit (SFEC) scheme will be extended to more companies with the qualifying criteria lowered. This scheme is tailored to SMEs who fulfil the eligibility criteria during the qualifying period for Enterprise Singapore’s SkillsFuture Enterprise Credit (SFEC) to receive a one-off credit of up to $10,000 per firm to invest in both enterprise and workforce transformation concurrently.

Under the enterprise transformation component, companies will be able to use up to $7,000 of the SkillsFuture Enterprise Credits which can be used to cover up to 90% of out-of-pocket expenses on qualifying costs for SFEC-supportable programmes (including PSG) and the remaining minimum credits of $3,000 must be allocated to workforce transformation.

What if I am not eligible for PSG?

The goal of PSG from the Singapore government is to help companies increase their productivity and is limited to approved solutions and services. If you are not eligible for PSG, check out Digital Growth Grant (DGG) by EBOS Cloud Accountants now.

I am the Sole Proprietor of my business. Am I still eligible for PSG and DGG?

Yes, Sole Proprietors are still eligible for PSG and DGG.

Since the grant is 50%, does it mean I pay EBOS 50% only?

You will have to make 100% of the payment once the project is completed before the PSG reimbursement can be made. Therefore, it is important for companies to ensure that they can manage their cashflow for the payment, as the process for implementation will takes 1 to 2 months.

If you like to complete the project in a shorter time period, please inform our Success Partner and they will advise you accordingly.

Can I wait for the letter of offer, before I pay EBOS?

Yes, you can wait for the Letter of Offer to be given before paying a deposit to EBOS. This will mean that you will only book slot after the deposit has been paid.

Can you estimated the schedules required to complete the set up, migration and training?

Every job is different and training is based on each industry requirement. Our success team will guide you to prepare for the necessary documents and information needed for a speedy migration of the system. Hence the estimated schedule depends on the time taken for you to confirm the information as well as the packages chosen.

We will be able to provide you with a better gauge of the schedule once you have shared the details of your company financial and operation status with our Success Partners and Cloud Accountants. Contact Us for a free, no obligation consultation today!

If I need more features for my Cloud Accounting PSG Grant, can I still apply for PSG?

As the PSG is a government grant, it is highly regulated by Enterprise Singapore. Our original PSG package cannot be modified. However, any additional features can be quoted by our company separately and they have to be invoiced separately from the PSG project. Kindly inform our Success Partner who can guide you further on this.

My staff cannot understand English, can the training be non English?

Yes. We can train your employees in English, Mandarin and Tamil. Our trainers are very patient as we understand it is not easy to go through digitalisation for matured employees. Hence, we suggest that companies opt for more training hours to ensure that employees can fully comprehend the new system and make full use of system wisely.

Stand a chance to win 1-year FREE XERO accounting software by engaging with us now!

Book your 30mins Complimentary Consultations

SAY NO MORE. I AM INTERESTED TO FIND OUT

REWARDS

Get EBOS and get Access to a suite of Perks from our Partners

Claim 12-months FREE Financio Premium when you sign up with EBOS Cloud Accountants services

Promo : BCP100

Get a 3-month extension on your free trial and 25% off Spenmo subscription fees thereafter

Promo : Spen100

Save 50% off your 1-month Premium subscription in Intellinz KYC Due Diligence Marketplace

Promo : Intel50

Earn up to 5% Cashback valid on eligible Marketing & SaaS purchases

Promo : Aspire100