ACRA FILING

Managing a company requires more than just a click of button to incorporate the company. All locally-incorporated companies are required to file Annual Returns with ACRA.

Staying Compliant with ACRA

Staying Compliant

with ACRA

All Singapore companies must follow certain legal obligations every year regardless of their size or business structure and prepare the correct Annual General Meeting documents for submission to ACRA. Although all the filing can be done online easily 24/7, a busy entrepreneur may forget a deadline and be unsure what if the type of documents required for Accounting and Corporate Regulatory Authority (“ACRA”). Annual filings are mandatory for both active and dormant Singapore companies despite whichever type of entities that you have in Singapore.

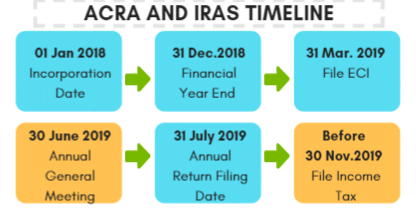

ACRA and IRAS Timeline

After setting up a company in Singapore, you will need to prepare ACRA filing and IRAS after every financial period irrespective of the type of entities that you have set up. Difference entities will have their own filing due date. Please refer to the compliant requirement for a Private Limited Company in Singapore.

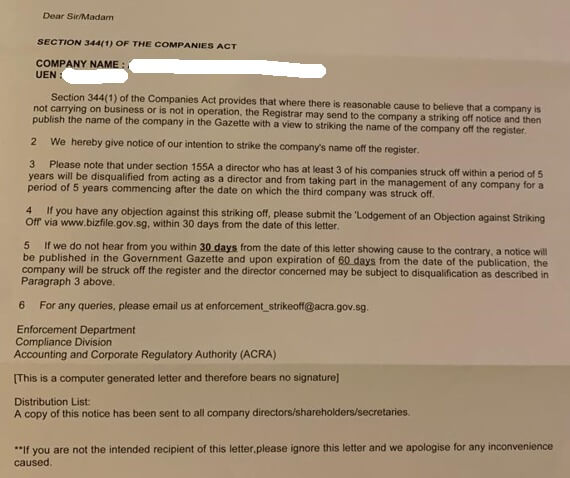

Non-Compliance of annual return filing with acra

ACRA can penalise a company for non-compliance for any of the following reasons:

- If the company does not hold its AGM on time

- If the company does not submit the Annual Return and financial statements

- If the financial statements presented at the AGM are inaccurate

Companies face a fine of at least S$300 for each non-compliance and even court summon.

Recently, ACRA has stepped up its enforcement action for non-compliant companies by issuing strike-off for companies who refuse to comply with the yearly mandatory ACRA Filing. This creates a disruption to the company operations when customers and suppliers know that the company is under strike-off process, which will also affect the reputation of the company and its directors.

Frequently Asked Questions

When do I need XBRL?

The company would be required to present 2 sets of financial statements, PDF and in XBRL format during the filing of Annual Return, if the company is:

- Insolvent (Total Assets – Total Liabilities = Negative Value)

- The company has a corporate shareholder for the financial year

For more details, please refer to XBRL Filing

Who is Responsible for ACRA Filing?

Company Secretary who is a Registered Filing Agent must remind the directors to compile with the ACRA filing requirements. Before ACRA filing the Annual Return, as part of the annual obligations, companies and directors are required to prepare and present an updated financial statement during Annual General Meeting.

Directors of the company are responsible to keep the source documents, prepare the accounting records and submit the financial statements of the company which must follow the Singapore Accounting Standards. Directors must prepare ACRA filing after every financial period irrespective of the type of entities that they have set up. To minimize mistakes from the incorrect filing of financial statements and reports, the company should outsource the services to a registered filing agent.

Who can be a Registered Filing Agent?

A Registered Acra Filing Agent not only helps you to file the Annual Return, but they should also be the appointed officer, corporate secretary. Accordingly to our corporate secretary specialist, Annual Return comes in 4 parts.

- Reviewing the Financial statement to determine the type of AGM documents

- Declaring of dividend which is declared during the Financial Year stated in the Unaudited Financial Statement.

- Filing with ACRA and paying ACRA Fee

In some circumstances, an XBRL report during the submission of ACRA Filing as per mentioned earlier. Therefore, it is important to understand the compliance requirements and come up with a plan to stay on top of them. After ACRA filing, the same set of financial statement would be ready for IRAS filing.

How do I file my Annual Return with ACRA?

The appointed officers of the company may file the Annual Returns online via BizFile+. The company should engage the services of a registered filing agent to file the Annual Return on behalf of the company so as to minimise mistakes from the incorrect filing of financial statements and reports.

All locally incorporated companies are required to file Annual Returns. The appointed officer of the company e.g. director or company secretary may file the Annual Returns online via BizFile+. Alternatively, the company can engage the services of a registered filing agent to file the Annual Return on behalf of the company.

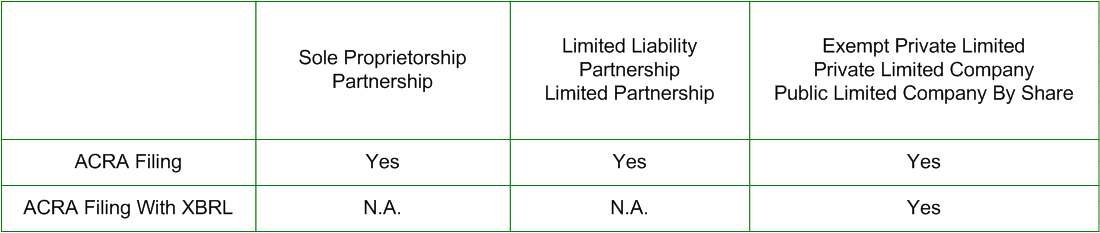

Do all companies have the same ACRA filing requirements?

Depending on the type of company, different sets of documents for AGM and Annual Return would be needed for yearly submission.

Why must I arrange ACRA Filing on a timely basis?

All companies must meet compliance requirements. Given that Due Diligence is required for credit terms and bank loan applications, it gives banks and suppliers a reason to reject your application as you do not have a habit to maintain your accounting record and proper documentation. This will adversely affect your cash flow situation.

Attaching Audited Financial Statement in AR Filing

The Financial Reporting Standards of Singapore require all companies to prepare year-end Financial Statements that provide a summary of their financial activities during the accounting year. Companies that require to be audited will have to attach audited financial statements as part of their Annual Return submission. The auditor has to be re-appointed during every AGM as well.

Small Company Filing for ACRA Filing

ACRA require small private companies to submit unaudited financial statements if they meet two of the three following criteria:

- Total annual revenue from the past financial year is less than S$10 million

- Total assets from the past financial year are less than S$10 million

- Total employees in the past financial year are fewer than 50

When is the deadline for ACRA Filing?

Based on the ACRA timeline, please stick to within 5 months from your financial year-end for listed companies and within 7 months from your financial year-end for the non-listed companies.

Need help? From our ACRA

Approved Corporate Secretary