Corporate TAX Filing

Minimize your taxes with effective tax planning with EBOS.

All About Corporate TAX FILING in Singapore

Singapore companies have 2 basis compliances to fulfill in every financial year. First, business owners must prepare the Financial Statement for annual ACRA filing within 6 months of the Financial Year End. Thereafter, all companies must file Corporation Tax Return by 30 November or 15 December of the following year. Inactive companies and companies in red must prepare tax report, tax schedules and Form C, C-S and C/S Lite

Singapore has been recognized as one of the most Pro-Business Country for setting up a company. To encourage entrepreneur spirits, IRAS (Inland Revenue Authority of Singapore) has raised the annual revenue threshold for Form C-S from $1 million to $5 million.

Form C-S is a much-simplified Tax Filing method and will reduce the lead time for the preparation of corporate tax filing Singapore based. Companies will not be required to submit Financial Statements and Tax Computation during E-Filing. However, IRAS has the authority to request for the documents at any time.

What is the obligation for Company TAX FILING in Singapore?

- Estimated Chargeable Income (“ECI”) within 3 months of Financial Year End

- Corporate Income Tax – Form C or Form C-S by 30 November of the following financial year.

What is estimated Chargeable Income (ECI)?

It is computed based on company taxable income after deducting tax allowance expenses. All companies are required to file their ECI on a timely basis even when the estimated ECI is zero.

HOW CAN I FILE MY OWN CORPORATION TAX?

Companies can file their own Corporate Tax after the Unaudited Financial Statement fit for ACRA filing is properly prepared. Before preparing your tax computation, it is important to identify the Key Corporate Tax issues as follow.

| Type of Corporate Tax | Rate |

|---|---|

| Tax rate on business profits | 0 – 17% |

| Tax rate on capital gains | 0% |

| Tax rate on dividends payable to shareholders | 0% |

| Tax rate on foreign-sourced income not repatriated to Singapore | 0% |

| Tax rate on foreign-sourced income repatriated to Singapore | 0 – 17% |

Double Tax Treaty for Foreign Sourced Income

Singapore has signed Double Taxation Agreement with over 80 countries. With DTA, it boosts Singapore as an international headquarter. A Singapore based company who has already paid tax for its overseas operations will be able to claim relief for the tax payment paid on foreign sourced income.

Singapore Tax Residency Submitting a Certificate of Residence to the foreign country, if you bring in foreign income from a treaty country.

Overseas Tax Residency You are a tax resident of a treaty country you will have to submit to the Inland Revenue Authority of Singapore, a completed Certificate of Residence from Non-Residents (Claim for relief from Singapore Income Tax Under Avoidance of Double Taxation Agreement) that is duly certified by the tax authority of the treaty country.

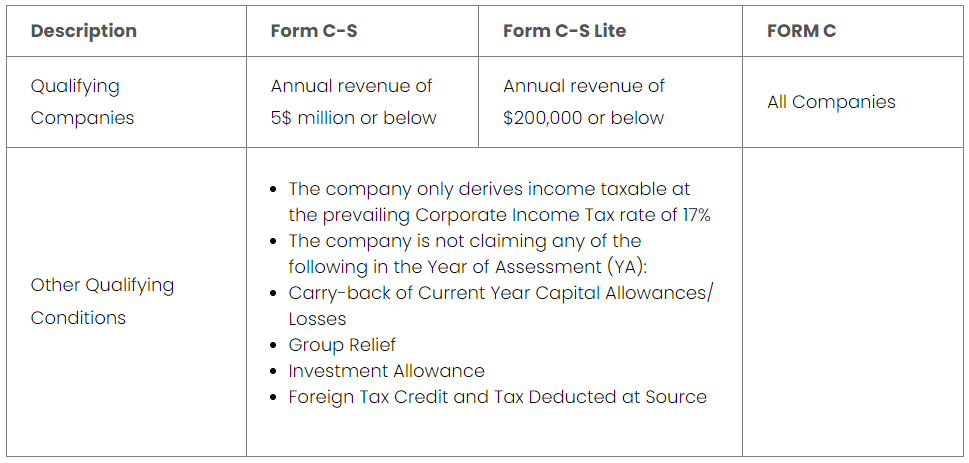

What is Form C-S/ Form C-S (Lite)/ Form C?

Form C-S/ Form C-S (Lite)/ Form C is a Corporate Income Tax Return for your company to declare its actual income. An overview of the types of Corporate Income Tax Return is as follows:

| Description | Form C-S | Form C-S Lite | FORM C |

|---|---|---|---|

| Qualifying Companies | Annual revenue of 5$ million or below | Annual revenue of $200,000 or below | All Companies |

| Other Qualifying Conditions |

|

||

Form C-S is a simplified Corporate Income Tax Return for qualifying small companies to report their income to IRAS on a annual basis. If your company qualifies to file Form C-S, it is not required to file its financial statements and tax computation together with Form C-S. However, it is mandatory to prepare these documents and be ready to submit them upon IRAS’ request. Form C-S is comprised of:

- A declaration statement of the company’s eligibility

- Information on tax adjustments

- Information from the financial statements

If your company qualifies to file Form C-S, it is not required to file its financial statements and tax computation together with Form C-S. However, your company should prepare these documents and be ready to submit them upon IRAS’ request.

What is Form C-S (Lite)?

Form C-S (Lite) is a simplified version of Form C-S that requires only 6 essential fields to be completed by companies with straight-forward tax matters.

Similar to Form C-S, your company is not required to file its financial statements and tax computation. However, it is mandatory to prepare these documents and be ready to submit them upon IRAS’ request.

What is Form C?

If your company does not qualify to file Form C-S or Form C-S (Lite), you must file Form C.

Your company is required to file its financial statements, tax computation and other supporting documents together with Form C.

Dormant Companies with Related Party Transactions

From YA 2020, a dormant company is not required to complete the Form for Reporting Related Party Transactions, even if the value of the related party transactions disclosed in the financial statements for the financial period exceeds S$15 million. Therefore, dormant companies can file Form C-S or Form for Dormant Company instead.

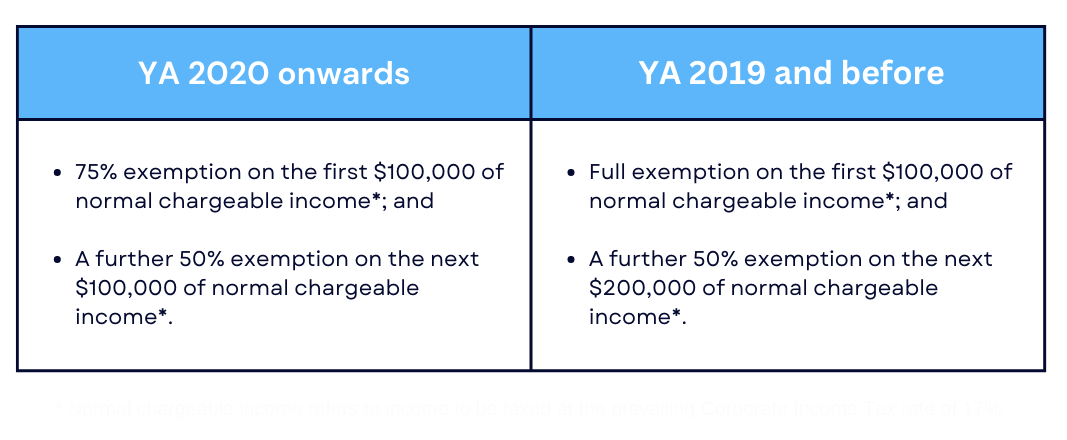

Corporate TAX EXEMPTION schemes for Start-ups

The tax exemption scheme for new start-up companies was implemented in the Year of Assessment (YA) 2005 under Section 43 of the Income Tax Act 1947 to encourage entrepreneurship and the growth of our local businesses.

The tax exemption under the scheme was amended with effect from YA 2020, while other incentives for enterprises to enhance their capacities was strengthened in Budget 2018.

The maximum exemption for each YA is $125,000 ($75,000 + $50,000).

The following are the tax breaks available to eligible enterprises for their first three consecutive fiscal years:

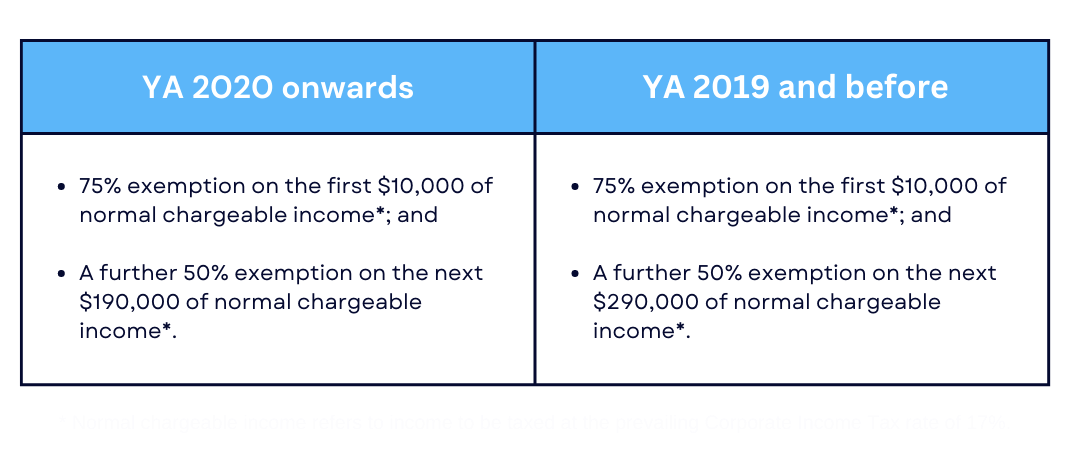

Partial TAX EXEMPTION schemes for companies

All companies, including companies limited by guarantee, are eligible for partial tax exemption (PTE) under Section 43 of the Income Tax Act 1947, unless they are claiming the tax exemption for new start-up companies.

It was announced in Budget 2018 that the tax exemption under the partial tax exemption scheme would be revised with effect from the Year of Assessment (YA) 2020 as other support for companies to build their capabilities have been strengthened.

The maximum exemption for each YA is $102,500 ($7,500 + $95,000).

The tax exemptions for qualifying companies are as follows:

Qualifying Conditions for Tax Exemption Scheme for New Start-Up Companies

All new start-up companies are eligible for the tax exemption scheme, except:

- Companies whose principal activity are that of investment holding

- Companies that undertake property development for sale, investment, or both

The new start-up company must also:

- Be incorporated in Singapore

- Be a tax resident of Singapore for that YA

- Have its total share capital beneficially held directly by no more than 20 shareholders throughout the basis period for that YA where:

- All the shareholders are individuals; or

- At least 1 shareholder is an individual holding at least 10% of the issued ordinary shares of the company

Engage EBOS Cloud Accountants for more information on Singapore corporate tax exemptions

TYPES OF COMPANY TAX FILING FINE IN SINGAPORE

It is important to note that every company or business incorporated in Singapore is required to corporate tax services under the Income Tax Act. Any revenue gained from Singapore or transferred from foreign countries is liable to be charged under corporate tax.

The statuary board of Singapore, IRAS, maintains a strict policy for corporate tax filing and imposes heavy fines on companies for inaccurate tax filing, late or non-payment of corporate tax and especially Tax evasion.

Let’s take a look at some of the penalties for the following:

Inaccurate Tax Filings

· 200% of the tax undercharged, Fines of up to S$5,000; and/or Imprisonment of up to 3 years if convicted

Late or Non-Payment of Corporate Tax

· 5% penalty of the tax undercharged, with subsequent penalties of 1% imposed for each month the tax remains unpaid (up to a total of 12% penalty).

Tax Evasion

· 300% of the tax undercharged, Fines of up to $10,000 fine and/or 3 years imprisonment if convicted.

Singapore companies are subjected to routine tax audit periodically. IRAS will also conduct their own investigation into your business if they suspect that you are making attempt to evade tax or you have been failing to submit tax on a timely basis.

Which is why it is important to engage with a qualified Cloud Accountant to ensure that your Corporate Tax Filing is conducted in a timely and accurate manner every year in Singapore.

What kind of Corporate TAX SERVICES in Singapore is required?

Corporate Tax Planning

EBOS will work on the best method that is suitable for your company during the preparation of unaudited financial statements. You will understand your estimated tax payable almost 1 year in advance of the Year of Assessment for better cash flow management.

EBOS offers expert tax advisory services designed to help entrepreneurs and businesses navigate the complexities of taxation. Our team of experienced professionals provides tailored guidance to ensure businesses comply with local tax regulations while optimizing their tax positions.

We work closely with our clients to optimize their tax positions, implement effective bookkeeping systems, and ensure timely payroll management—all while delivering exceptional customer service to simplify complex financial tasks.

Corporate Tax Computation & Schedules

EBOS follows the standard procedure required by Inland Revenue Authority of Singapore. We will look at your financial statements, prepare the workings on schedules to be added into your Tax Computation. This is important step because Tax audit always fail at this part when companies are unable to furnish the tax computation and workings prepared according to the Singapore Tax Standards.

Preparation and Filing of Form C or Form C/S

Corporate Tax Filing season starts from June to November annually. Our tax specialist will review the tax computation done previously to ensure that all updated rebate and tax exemptions are updated based on the current year government’s guidance. Tax regulations change every year due to the change of policies from the Singapore government. Therefore, it is our duty to ensure that you are the latest update on your Form C & C/S every year just before filing.

Replying to IRAS

As you are aware that all companies are subjected to Tax Audit. When you engage EBOS Cloud Accountants, we are always ready to assist you to answer all tax queries. Simply snap the IRAS query letter, email to EBOS Cloud Accountants. We will dig through our working, schedules and Tax Computation to reply to IRAS on your behalf.

Still figuring out who should help you?

Engage EBOS Cloud Accountants for your online business solutions and corporate tax services in Singapore now.

START WITH US NOW!