XBRL FILING

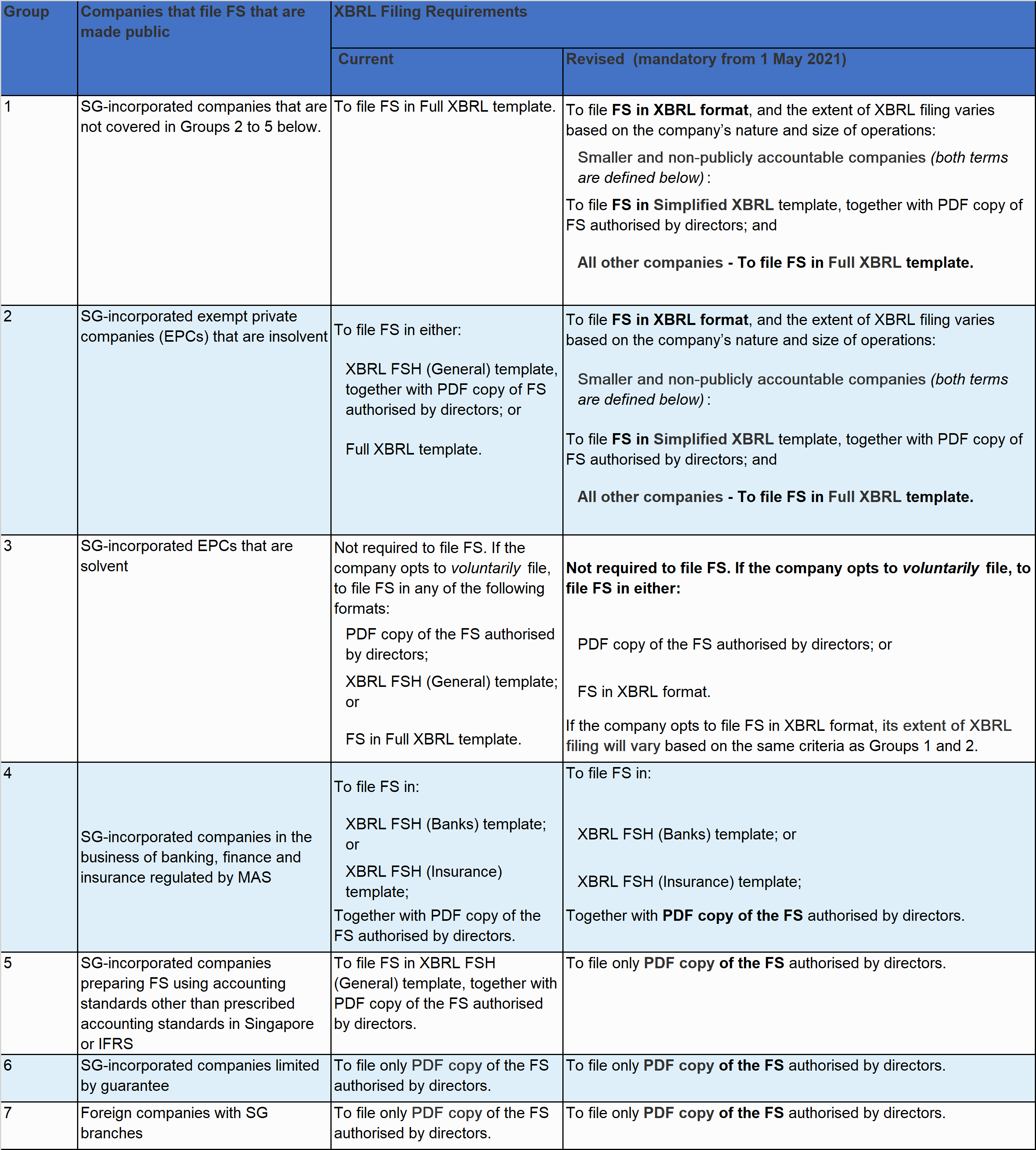

Companies are required to file Financial Statement in XBRL format in BizFinx system since 2007. From 1st May 2021, XBRL filing can be done in Simplified and Full Set.

XBRL Filing in Singapore

Companies in Singapore must comply with various ACRA and IRAS requirements. One of the important filing requirements from a Singapore incorporated company is the preparation of financial statements in approved format by the Accounting and Corporate Regulatory Authority (ACRA). Thereafter, converting it into XBRL (eXtensible Business Reporting Language) in accordance with the revised XBRL filing requirements, to enhance the dissemination of comprehensive and useful business information to the business community through the implementation of BizFinx.

WHAT IS XBRL?

XBRL stands for eXtensible Business Reporting Language. It is an internationally recognised language used in computers for business reporting and electronic communication of business information between organisations.

With effect from 1st May 2021, Accounting & Corporate Regulatory Authority (ACRA) requires Singapore incorporated companies to file their financial statements in simplified and full XBRL format. Most companies currently file their Financial Statement in PDF format. ACRA believes that the use of XBRL will achieve the objectives of facilitating the conduct of business in Singapore, providing more value-added financial information and enhancing the regulatory environment with improved transparency and timely dissemination of relevant financial information.

In March 2020, ACRA announced the revision of filing requirements for Singapore incorporated companies. The revised XBRL filing requirements are expected to take effect in late Q3 2020. By late Q3 2020, all companies must file their financial statements in accordance with the revised XBRL filing requirement.

FILING REQUIREMENTS & DATA ELEMENTS

FAQS

Who is Responsible for XBRL Filing?

According to ACRA, the companies directors are responsible for filings within the due date at the time. They are also fully responsible for the correct representation as well as the accuracy of the information provided. As a result, hiring an XBRL filing specialist may be the best option as it provides a solution that saves directors time which can be spent improving the day-to-day business.

What happens if you do not have XBRL?

XBRL together with PDF format of Financial Statement, also known as unaudited Financial Statements forms the requirement for your Annual Return Filing. If you do not have the complete set of documents, you will not be able to file it. Many cloud accounting software can churn out Cashflow statements, Profit & Loss, and Balance Sheet but are unable to prepare the necessary documents for ACRA. Failing to prepare the necessary documents on time will result in a delay in the submission of Annual Return Filing. Fine will starts at $300 onward which is more than the cost of a Simplified XBRL to be used.

What is a Smaller Company?

A smaller company mentioned in the table above refers to a company whose revenue and total assets for the current financial year do not exceed S$500,000, respectively. The assessment of revenue and total assets should be made based on the FS that is required to be prepared under the Companies Act. When the company controls, jointly controls, or has significant influence over other entities, its revenue and total assets should be assessed based on consolidated figures unless the company is exempted by the accounting standards or by ACRA from preparing consolidated FS.

The amount thresholds of S$500,000 are to be determined based on the FS, regardless of the number of months in the financial year covered by the FS. For FS presented in foreign currency, revenue should be translated based on average rates over the financial year and total assets to be translated based on the closing rate as of financial year-end.

Who Must Prepare XBRL Filing?

Companies are required to apply the revised filing requirements and data elements on or after 1 May 2021;

- Companies can opt to voluntarily apply the revised filing requirements and data elements from 16 May 2020 to 30 April 2021 (both dates inclusive);

- Companies that file their FS before 1 May 2021 can continue to prepare and file the FS using the current filing requirements and data elements.

There are four templates to be used by companies to meet the revised filing requirements and data elements:

- Full XBRL template – The number of data elements for this template has been reduced by 50% to about 210 data elements. It will capture the information in primary statements and selected notes to FS;

- Simplified XBRL template – This template, which replaces XBRL FSH (General), has about 120 data elements. It will capture the complete information in the statements of financial performance and position;

- XBRL FSH (Banks) template – There is minimal change to this template. This template has about 80 data elements; and

- XBRL FSH (Insurance) template – There is minimal change to this template. This template has about 80 data elements.

Exemption from XBRL

Some companies can be exempted from preparing XBRL and small companies can file Simplified XBRL. Please refer to the list below for the type of XBRL filing requirement.

Those that are exempted include the following:

- Commercial and merchant banks;

- Registered insurers in Singapore;

- Financial companies.

Should you have doubts, please consult EBOS Cloud Accountant, Success Team as soon as you start your business to have a head start.

FSH

XBRL- 10% off for EBOS member

Simplified

XBRL- 10% off for EBOS member

Full Set - Single

XBRL- 10% off for EBOS member

Consolidation

XBRL- 10% off for EBOS member

START WITH US NOW!