A business structure is a category of organization that is legally recognized in a given jurisdiction and characterized by the legal definition of that particular category. Here are the 4 main types of Business structures in Singapore.

Sole-Proprietorship (one owner)

A sole proprietorship is an enterprise that can be owned and controlled by an individual, a company. There are no partners for this business. Examples include self-employed decorators, vendors such as chicken rice sellers, mechanics, and freelance photographers. Sole proprietorships may cooperate, or they may hire other people to help run the business. Sole proprietorships are usually small family businesses that can be established with relatively little capital. Start-up funds usually come from personal savings and borrowing. Many well-known companies started as sole proprietorships, such as Charles & Keith.

Tax implications

Sole Proprietorship must report all business income or losses on the personal income tax return; the business itself is not taxed separately. Medisave top up based on annual revenue and age is required annually before ACRA renewal. The rate is start from 4% to 10%.

Limited Partnership

A limited partnership (LP) is a vehicle for doing business in Singapore. It is a partnership consisting of at least two partners, including at least one general partner and one limited partner. LP does not have a legal entity independent of its partners, that is, it cannot sue or be sued or own property in its own name. An individual or company can be a general partner or limited partner of an LP. Unless all general partners live outside Singapore, the appointment of a local manager is not mandatory. The general partner is responsible for the actions of the LP and is responsible for all debts and obligations of the LP. If the limited partner does not participate in the management of the LP, he shall not be liable for the debts and obligations of the LP that exceed the agreed contributions.

Tax implications

Limited partnerships do not have to pay taxes themselves. Instead, partners should be taxed on their share of the partnership’s profits and gains (or can request a reduction or exemption of their share of losses), regardless of whether the profits and gains are distributed to the partners. Likewise with sole-proprietorship, annual Medisave top up is mandatory.

Limited Liability Partnership

A limited liability partnership (LLP) allows a partnership structure in which the liability of each partner is limited to the amount of business they invest. Having business partners means diversifying risks, using personal skills and expertise, and establishing a division of labor. Limited liability means that if the partnership fails, the creditor cannot recover the partner’s personal assets or income. LLP is common in professional businesses such as law firms, accounting firms, and wealth management companies.

Tax implications

Similar to LP, LLP does not need to pay taxes at the entity level. Instead, each partner will be taxed on his or his share of income in the LLP. If the partner is an individual, his share of income from the LLP will be taxed according to his personal income tax rate and contribution to Medisave is done after the year end.

Company (Pte Ltd)

A company is a shareholder-owned enterprise. Shareholders are individuals or other businesses that provide capital for the company. They are sometimes referred to as joint stock companies because the shares (or stocks) of the company are jointly held by many entities. A company is a registered enterprise, that is, there is a legal difference between the company owner (shareholder) and the company itself. The company is regarded as an independent entity with its own legal rights and obligations.

Tax implications

The company’s profits are taxed on the company when they are earned. Dividend distributed to shareholders will not be taxed. The corporate income tax rate in Singapore is 17%. By registering your business as a private limited company (PLC) and setting up a private limited company in Singapore, the company is entitled to:

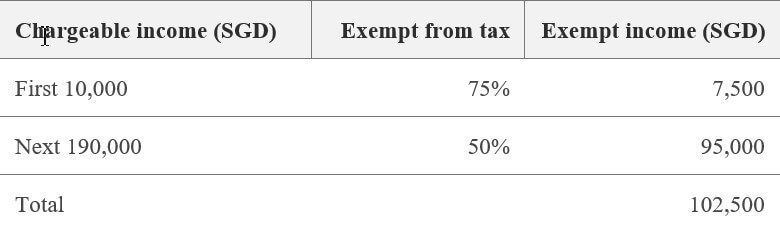

Tax Exemption for New Start-up Companies:

Newly established Singapore incorporated companies are entitled to new start-up companies exemption.

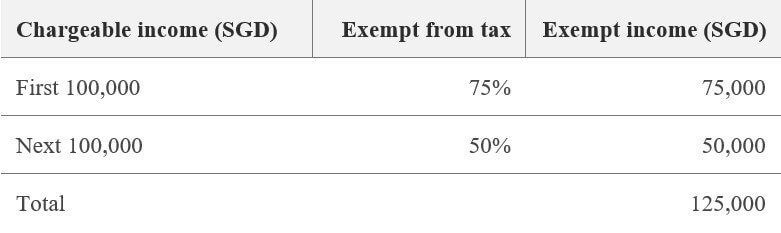

Partial tax exemption (income taxable at normal rate):

The start-up exemption is not available to property development and investment holding companies.

Singapore adopts a one-tier taxation system, under which all dividends paid by Singapore-resident companies are tax-exempt in the shareholder’s hands.

For in-depth understanding of business structures in Singapore and their respective tax implications, feel free to contact EBOS cloud accountants!