E-invoicing in 2020 no longer refers to the sending of invoices from email to email. E-invoicing is the automated creation, exchange and processing of requests for payment between customers and suppliers using a structured digital format that is readable from their own accounting system. Invoice formats such as PDF, Word Document, and paper-scans are not considered E-Invoices as data-entry is still required.

Singapore’s IMDA has implemented the Nationwide E-Invoicing network via (PEPPOL). Starting from May 2020, IMDA’s E-Invoicing Registration Grant will provide companies with a one-time payment of $200 per UEN, upon their first registration to the E-Invoicing Network until 31 December 2020. As businesses look for digital solutions to allow their staff to work remotely, this grant will directly assist in enabling E-invoicing features on their existing or new solutions. Payment will be disbursed by PayNow Corporate to the registered UEN.

Suppliers who provide services and products are strongly encouraged to submit E-invoices to the Government agencies via this network.

Benefits of E-Invoicing

· Improve efficiency by eliminating manual data-entry.

· Reduce cost by reducing hard-copy printing and postage fee.

· Get paid faster because E-invoicing can accelerate invoice processing and payment duration.

· Send E-Invoices seamlessly to overseas and local partners who are on PEPPOL Network.

· Reduce carbon footprint because hard-copy prints are a thing of the past.

How to connect to the PEPPOL Network?

· If you are using an Accounting / ERP software that is PEPPOL Ready, you just need to activate the feature on your solution.

· If you are using an in-house ERP software, businesses can get connected to the PEPPOL Network through certified

Access Point providers or PEPPOL Ready Service Providers with solutions already connected to the network.

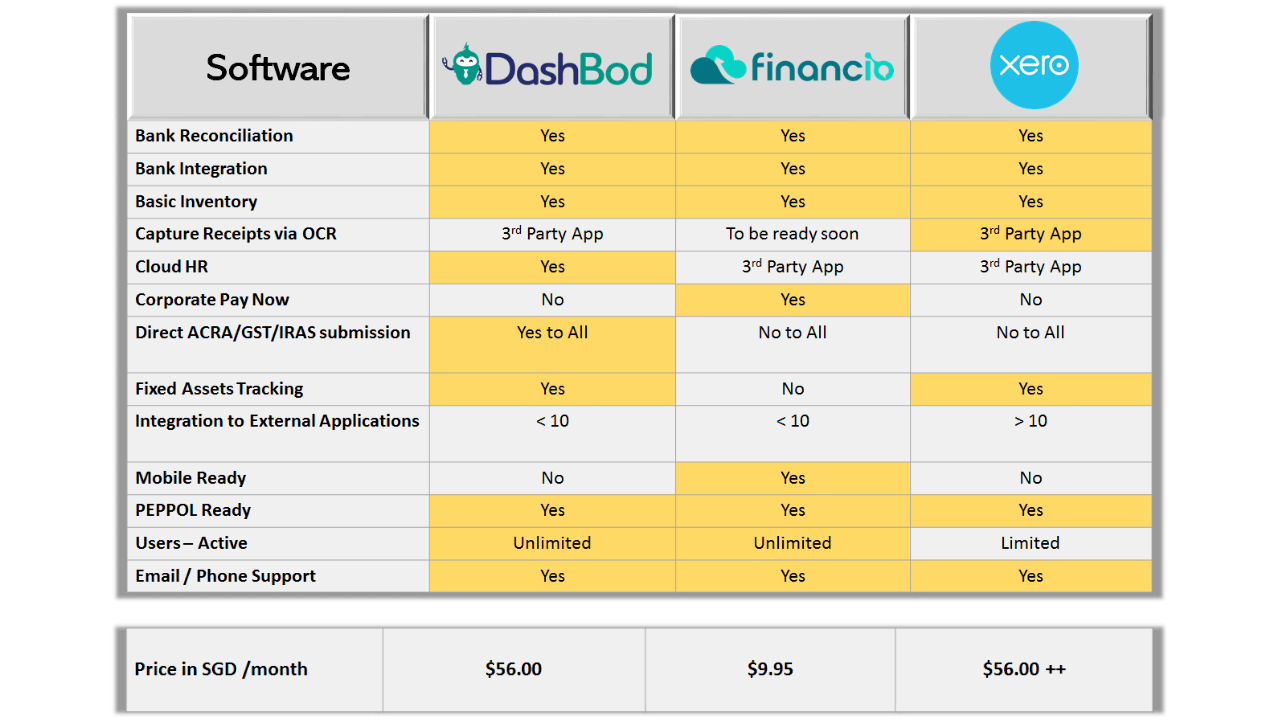

Once you have identified your business needs, we will share a quick comparison of some of the popular PEPPOL ready accounting software that would best fit our Singapore-based businesses.

· Xero has integration with many applications and is suitable with company wants to in

· Financio Premium has links to Corporate PayNow and is simple to use for Start-up Businesses.

· SMECEN Dashbod comes with built-in Cloud Human Resource that is supported by ACRA and IRAS submission.

Dashbod x Financio x Xero Comparison Chart

The boxes highlighted in Yellow are the best choice for that category

After speaking to fellow accountants and entrepreneurs, EBOS Cloud Accountants found out that a crucial step towards embarking on PEPPOL-ready solutions, is to identify the business process. EBOS Cloud Accountants will understand your needs and how you want to achieve your goal through E-invoices and Business Process Re-engineering.

We strive to be as accurate as possible but do let us know if there is any new feature that we can add on to this comparison chart. No matter, please do ensure that you talk to a Cloud Accountant before making your final choice.

A Cloud Accountant is someone who only deals with Cloud Accounting and has worked with multiple Cloud Accounting Softwares, thus will give a neutral analysis on your business needs.