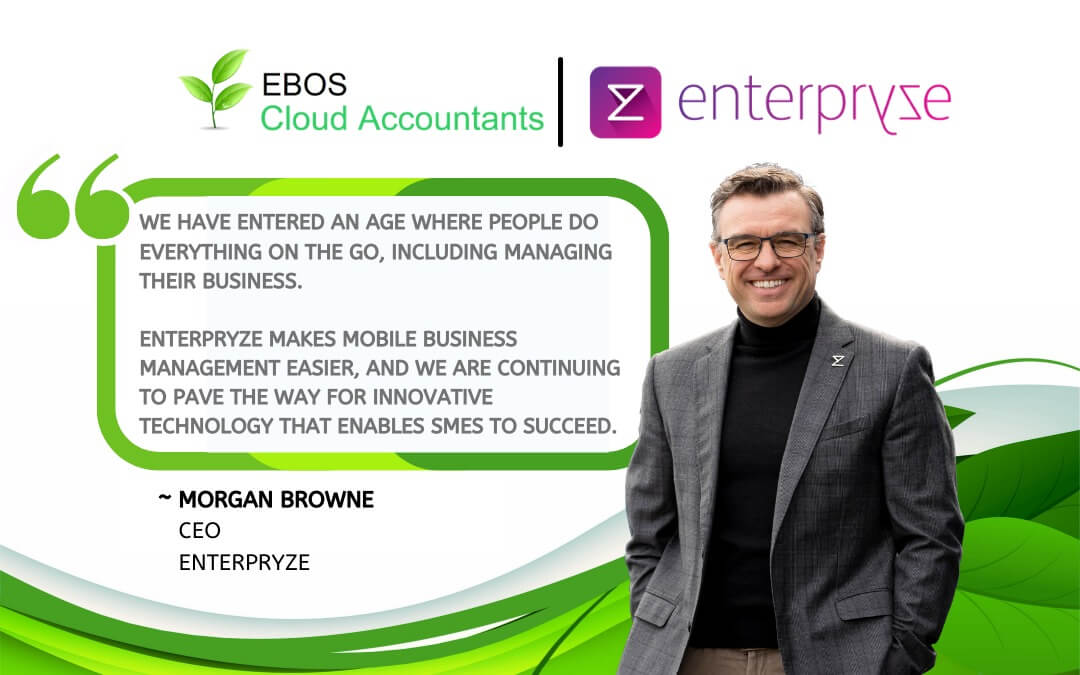

“Enterpryze” is Now an Official EBOS Cloud Accountants Accounting Partner

We’re so excited to be partnering up with Enterpryze to include it in our cloud solutions roster.

Enterpryze Singapore is a cloud-based invoicing, accounting and ERP platform designed for small businesses to super scalers. Their solution allows all organisations and individuals to manage finances, create and send invoices much quicker, integrate with their bank accounts and operate effectively!

They aim to help all small-medium enterprises (SMEs) be the best business they can be by providing scalable, flexible cloud-based business management solution. Which aligns perfectly with EBOS’s goals!

Enterpryze also provides various services to assist businesses with accounting, banking, sales, purchasing, CRM, Expense, and Stock and Service.

EBOS Cloud Accountant collaborated with Enterpryze to interview Mr. Morgan, CEO of Enterpryze, to get valuable insights into their company and what our new found partnership will bring in 2021!

Questions and Answers

1.Introduction of Enterpryze and their goal in 2021?

Enterpryze is a cloud-based software driven to streamline business and accounting processes for organisations of all sizes.

Our goal is to provide a scalable and flexible cloud-based business management solution with a suite of complimentary mobile apps to help businesses optimise their processes and track cashflow with ease.

In 2021, Enterpryze will continue our efforts to be at the forefront of business innovation – introducing more tools, integrations, features, partnerships, and programmes that will allow our users to run their organisations at maximum efficiency.

In addition to that, Enterpryze will continue to work with UOB, IMDA, ESG and others to introduce more methods of digitalisation to the SME community in Singapore.

2. What are some of the unique features of Enterpryze accounting & business systems?

One key unique feature is Enterpryze’s ability to grow with an SME.

Even if a company starts with small requirements, Enterpryze will continue to scale to meet that company’s needs as they grow to become larger SMEs. Our solution is built for evolution.

Our features include real-time accounting, complete Customer Relationship Management (CRM) systems, expense tracking, purchase order management, sales monitoring, SAP Business One integrations, service ticket control and total inventory management.

Enterpryze utilises simple yet powerful features to improve business performance.

Matched to their unique demands, business owners can experience these features according to their specified Enterpryze subscription. This means full access to the tools, metrics and analytics tailored for industries of multiple employees, various business operations and different industries.

3. What sets Enterpryze apart from other Cloud Accounting Solution providers?

Enterpryze incorporates a unique maturity model into each subscription plan to ensure that our users’ flexible preferences are never limited.

Our adaptable-first approach provides business owners with the option to upgrade anytime with seamless data migration and zero hassle when their businesses grow in employee size, inventory needs, sales tracking and more.

Enterpryze is also proud to partner with UOB, bringing the revolutionary and seamless connection between software and banking account. With this partnership, features such as real-time bank feeds, mobile digital payments and bank reconciliation are available – exclusive to Enterpryze users.

Users can also get paid much faster via Enterpryze’s digital payments on platforms like Paynow, Square, Stripe, Mastercard and mobileCollect for collecting payments on-the-go.

4. What other services can Enterpryze provide for their customers?

Enterpryze caters to a wide net of business owners, startup founders, C-suite executives and solopreneurs.

But in addition to that, Enterpryze’s Accounting Partner Programme is geared towards accountants who require an end-to-end client management solution. This exclusive service provides accounting firms and other licensed accountants to streamline cashflow reporting for each client, access high-performance client data and build more revenue models as an Accounting Partner.

5. Why do you think it is important for SMEs to adopt digital solutions in 2021?

SMEs have the added advantage of being agile, even in turbulent times. When an SME or startup is committed to the adoption of digital solutions throughout their business there is potential to reduce costs and automate manual day-to-day processes. On a much bigger picture, digitalisation will directly increase SMEs ability to be competitive in their respective markets and allow them a deeper understanding of consumer behaviour.

6.What are the benefits of SMEs using InvoiceNow e-invoicing?

- You can automatically send and receive invoices directly through your finance accounting system. No more keying in transactions or need for duplication.

- Error reduction and faster invoices. Because all InvoiceNow documents are processed electronically, there is no need to enter manual data or scan documents. This reduces the risk of errors and delayed payments – allowing small business owners to get paid much faster.

- Send invoices securely. Invoice. Now is developed with stringent security measures in mind to protect your small business from risks.

7.What are some of the challenges SMEs face when adopting digital solutions?

Lack of expertise could be a major obstacle when SMEs try to digitalise their business. This can be solved with company-wide training on a frequent basis and of course, including digital dexterity as a priority skill when hiring new employees.

8. EBOS SG offers our partners the opportunity to participate in webinar collaboration to educate our customers and audiences on improving business success using digital solutions for entrepreneurs and start-ups.

What topic or theme can Enterpryze suggest to collaborate?

- How automation software is relevant in 2021

- How SMEs will benefit from cloud-based accounting compared to traditional accounting

- How integrated banking saves the day from admin

- What to look for when choosing a cloud accounting software

- Why cloud-based accounting software boosts productivity in the workplace

- Common cash flow problems that SMEs face

We are looking forward to collaborating with Enterpryze and make the lives of SMEs easier by simplifying your processes and aid help in other accounting functions for our clients by bringing you updated information in REAL-TIME using Cloud Accounting.

Join us and be part of EBOS Cloud Accountants as Partners Today!

Visit the Enterpryze page for more information and learn about the company.